Ryan Cook, Master of Environment Candidate

University of Melbourne, Australia

Sebastian Thomas, PhD; Research Supervisor

Director of the Sustainability Science Lab,

University of Melbourne, Australia

Abstract

Blue carbon ecosystems such as mangroves, tidal marshes, and seagrasses are increasingly recognized for their carbon sequestration capacity. While blue carbon science and policy research is advancing, private investment perspectives in relation to blue carbon are limited. Within this context, there are emerging shifts in global private capital markets aimed at more measured capital deployment and responsible investment. Such shifts often align with the United Nations Sustainable Development Goals (SDGs) and are guided by initiatives such as the United Nations Principles for Responsible Investment (PRI). This study uses an anonymous online survey and quantitative exploratory analysis of the perspectives of 44 large-scale private investment respondents, primarily from Australia. Respondents were segmented into actors with for-profit and not-for-profit motives. Key research findings were the comparatively low levels of respondent familiarity with the term blue carbon compared to similarly themed terms. This finding was supported by respondents indicating a low level of knowledge relating to carbon market investments. Respondents remained focused predominantly on return on investment (ROI), but many viewed associated co-benefits as an important factor when considering large-scale investment. This research expands on existing knowledge of investment in blue carbon with a more targeted focus on private large-scale investment motivations and constraints. Drawing on research findings, a conceptual model of blue carbon market constraints and motivations was developed.

Keywords: blue carbon,

responsible investment, private investment, ESG,

conservation finance

Acronyms and Abbreviations

| AGEDI | Abu Dhabi Global Environmental Data Initiative |

| BC | blue carbon |

| ESG | environmental, social, governance |

| GEF | Global Environment Facility |

| IPBC | International Partnership for Blue Carbon |

| IUCN | International Union for Conservation of Nature |

| NGO | non-governmental organization |

| PRI | Principles for Responsible Investment |

| RI | responsible investment |

| ROI | return on investment |

| SDGs | Sustainable Development Goals |

| TCFD | Task force on Climate-related Financial Disclosures |

| UNEP FI | United Nations Environmental Program, Finance Initiative |

Responsible Investment in Blue Carbon Resources

Blue carbon is a term used to define the capacity of coastal ecosystems (including mangroves, salt marshes, and seagrass) to sequester and store carbon (McLeod et al. 2011). Despite occupying 0.2% of the ocean surface, blue carbon (BC) resources contribute up to 50% of carbon burial in marine sediments (Duarte et al. 2013). BC ecosystems are powerhouses of carbon sequestration and storage with a carbon yield per unit area far greater than terrestrial ecosystems (McLeod et al. 2011). While BC science and policy dialogue advances, there is a notable absence of BC literature (academic and gray) focused on private sector perspectives, in particular relating to investment priorities and financial mechanisms (Thomas 2014).

For the most part, existing investment in BC comprises government and non-governmental organizations (NGOs), sometimes working in partnership Bayraktarov et al. 2016). Large-scale BC initiatives such as Global Environment Facility (GEF) Blue Forests; Abu Dhabi Global Environmental Data Initiative (AGEDI) Blue Carbon Demonstration Project; and the Yokohama Blue Carbon Project constitute multiple stakeholder programs that receive support underwritten by government agencies.

However, BC ecosystems are increasingly threatened. Global estimates of decline in BC ecosystems range from 340,000 hectares to 980,000 hectares destroyed annually in the past 50 to 100 years (Murray et al. 2011). Aside from carbon sequestration and storage, BC ecosystems provide a wide range of co-benefits for stakeholders, including coastal protection, improved fisheries health, sediment retention, and watershed protection and purification (Yee 2010).

A diversity of co-benefit income streams associated with BC investment benefits both investors (by reducing risk and potentially increasing returns) and local community stakeholders. For example, the Mikoko Pamoja BC project in Kenya has benefitted from “diversifying sources of mangrove-related income, such as beekeeping and ecotourism” (Wylie, Sutton-Grier, and Moore 2016). Therefore both income streams and co-benefits are important for positive private investment outcomes.

Responsible Investment

Responsible investment (RI) can be defined as “a process that takes into account environmental, social, governance (ESG) and ethical issues into the investment process of research, analysis, selection and monitoring of investments” (RIAA 2018). Globally, US$89.6 trillion is managed by stakeholders who are signatories to the United Nations Principles for Responsible Investment (PRI 2018).

The RI market is analogous to what some actors may classify as environmental, green, and sustainable investment with methodologies often intersecting. Broadly, these investment markets can be categorized into five groups: carbon; financing solutions for land use, land-use change, and forestry; clean technology; sustainable property; and water (Calvello 2010).

Sustainable Development Goals

With the advent of the United Nations Sustainable Development Goals (SDGs) in 2015, clearer investment pathways have emerged. What also became clear is that governments and intergovernmental agencies do not have the financial resources to meet the ambitious goals alone, so private investment mobilization is required (OECD 2016). Within this RI context, SDGs numbers 14 (“life below water”) and 13 (“climate action”) are most directly linked to BC. More broadly, the International Union for Conservation of Nature (IUCN) suggests 10 SDG targets can be achieved by protecting and restoring mangroves (Blum and Herr 2017).

Private Investment Opportunities

The United Nations PRI was established in 2005 and aims to provide guidance for private investment actors. The analysis of investments guided by the PRI estimates close to US$60 trillion in assets under management (Friede, Busch, and Bassen 2015). Projecting forward, it is estimated that up to US$7 trillion in new investment is required per year to 2030 in order to remain below the 2°C guardrail for climate change (OECD 2017).

For the purposes of this research, large-scale private investors are defined as entities with significant financial resources, expertise, and knowledge in investment. This includes pension funds, institutional investors, philanthropy, and retail investors (Huwyler et al. 2014). This study aims to understand the existing constraints and potential motivations for large-scale private investment in BC.

As a result of the systematic literature review process, we defined our fundamental research questions. First, is a dearth of blue carbon literature relating to finance and private sector perspectives constraining large-scale private investment? Second, with substantial private capital required to achieve the SDGs and significantly decarbonize, what can motivate targeted large-scale private BC investment?

We conducted an exploratory quantitative analysis of the current RI landscape with a focus on private investor perspectives. Prior to screening, 55 completed responses were received with a response rate of 40%.

Survey Methodology

The aim of this study was to analyze potential constraints and motivations to attracting large-scale private capital investment in BC resources. Exploratory data analysis was applied, defined as “an attitude, a flexibility, and a reliance on display, not a bundle of techniques” (Tukey 1980).

Survey Design

The survey design was intentionally brief, given that the respondent sample primarily comprised busy professionals based in Australia. Survey questioning was designed with adequate breadth and depth to provide rigorous exploratory data. This combination of brevity and selective depth is advocated to improve response rates among busy clinicians (Sahlqvist et al. 2011).

Respondents were required to answer 18 thematically clustered questions. The survey was anonymized from the point of distribution to increase the likelihood of statistically meaningful response rates. Rationalization for this approach was primarily the sensitive, proprietary nature of investment fundamentals among respondents and their organizations. Language was tailored to favor investment nomenclature to avoid marginalizing respondents.

The private investment sector includes a wide spectrum of actors, which can increase variability in survey responses. We chose to merge respondent entity categories to private for-profit and private not-for-profit. Respondents matching the aforementioned criteria who provide third-party investment advisory services to investors were also included in the survey.

Demand bias was identified as a possible impediment to data integrity. Disclosing BC as the topic of research could inflate BC-associated value among respondents as “asking the respondents about preferences for a public good could signal that the good is important and has significant value” (Carlsson, Kataria, and Lampi 2018). To reduce demand bias we did not disclose the topic of the research, rather the survey was described as focusing on responsibly themed investment.

Results and Discussion

This section covers details of the survey screening and discussions

of the respondents’ familiarity with BC and their opinions regarding

constraints to investments in the

carbon market.

Survey Screening

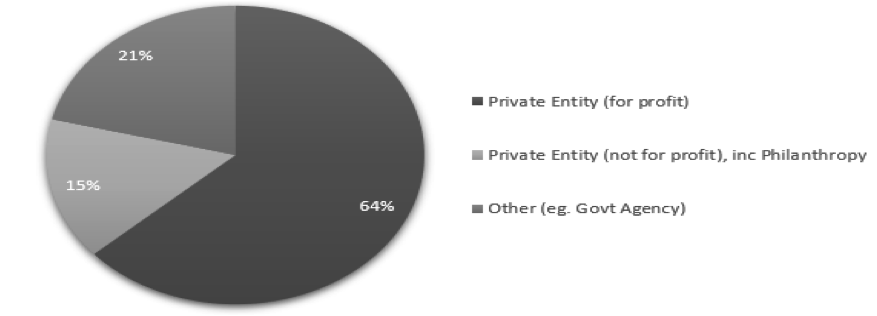

Excluding 11 non-private entity respondents (a result of initial respondents sharing the survey), an aggregation of the 44 private-entity survey responses was completed. Private for-profit entities represented 64% of all respondents, while private not-for-profit entities (including philanthropy) represented 15% of responses. Overall, a private respondent representation of 79% was deemed a sufficient sample (Figure 1).

Figure 1. Respondent Representation (n=55)

Source: Author, 2019.

Secondary screening was conducted to focus on RI practitioners. Ethical investment criticality in the investment decision-making process provided a snapshot of investor preferences and alignment with RI methodologies. The importance of ethical investing was scored from 0 to 5, with scores of 0 to 2 indicating low priority, scores of 3 and 4 indicating medium priority, and a score of 5 indicating high priority. Overall, 71% of respondents rated ethical investment as a high priority (i.e., a score of 5). This majority of respondents viewed ethical decision making as essential, providing further validation that the target respondents fulfilled the research criteria.

Respondent Familiarity with Blue Carbon

A baseline was assessed to ascertain current knowledge levels among respondents. Responses were elicited with the ranked categories “very familiar,” “slightly familiar,” and “not familiar at all.” Cross-tabulation analysis of respondents was completed with question three of the survey: “Has your entity (or an entity you advise) previously invested financially in a predominantly environmentally themed project or initiative?” The inferred relationship being that respondents who had previously invested in an environmental initiative were more likely to be familiar with BC. Overall, 41 of the 44 (93%) private investment respondents identified as having previously invested in a predominantly environmentally themed project or initiative.

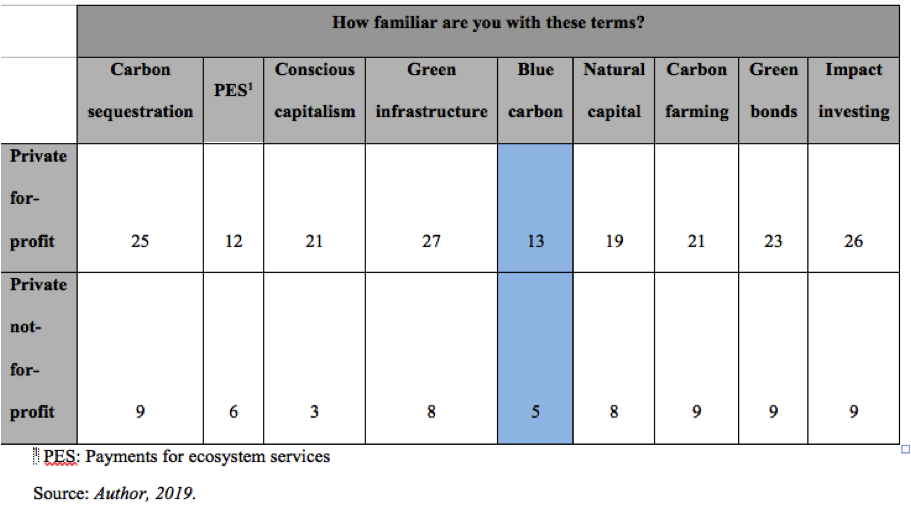

Despite this, BC rated equal to the lowest in familiarity among respondents, with 18 “very familiar” responses (Table 1). Respondent familiarity with more anthropocentrically focused terms such as carbon farming, green bonds, and green infrastructure provides a clear contrast, with the lowest-ranking anthropocentric term (“conscious capitalism”) obtaining 24 “very familiar” responses (Table 1). Further uncertainty regarding the phrase “slightly familiar” could imply that 59% of all private respondents had very little to no knowledge of BC.

Table 1. Respondent Familiarity with Environmental Terms, Measured as the Number of “Very Familiar” Survey Responses

A measure of respondent familiarity with more developed investments initiatives (such as the SDGs) was also undertaken. Familiarity with the more institutionalized International Partnership for Blue Carbon was significantly lower than with the term BC itself (Table 2). Acknowledging the global scale and predominantly financial focus of comparable institutional organizations (particularly the United Nations initiatives), the familiarity deficit presented in Table 2 is no less marked.

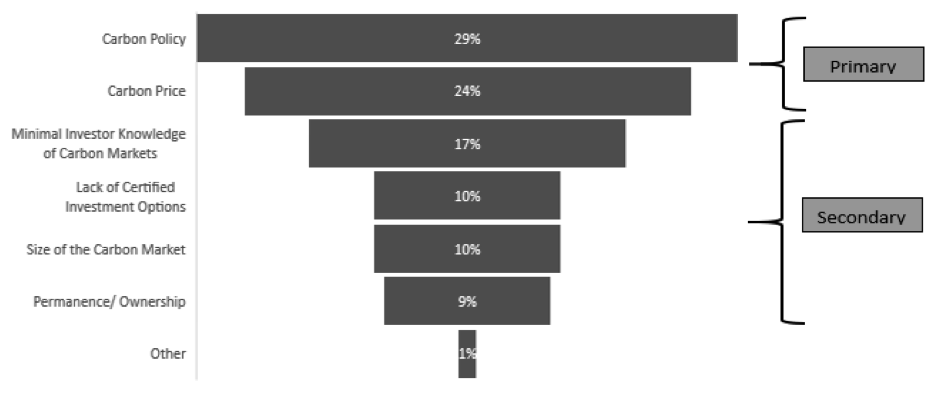

Table 2. Respondent Familiarity with Responsible Investment Initiatives

*2: SDGs – Sustainable Development Goals; TCFD – Task force on Climate-related Financial Disclosures; PRI – Principles for Responsible Investment; IPBC – International Partnership for Blue Carbon; UNEP FI – United Nations Environmental Program, Finance Initiative

Source: Author, 2019.

Carbon Market Constraints

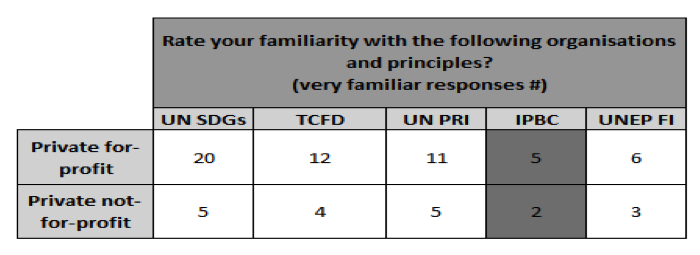

Respondents were asked to identify the three most significant constraints to large-scale investment in the broader carbon market. An improved understanding of constraints provides a foundation for removing obstacles and potentially increasing private BC investment. Primary constraints on carbon market investment identified by respondents focused upon carbon policy and carbon price (Figure 2). Policy and price uncertainty correlates with investment uncertainty and risk.

Figure 2. Carbon Market Constraints Respondents (n=44)

Source: Author, 2019.

With 17% of respondents acknowledging they have minimal knowledge of carbon markets, a concern for BC stakeholders is that this is an investment “dead zone.” The more unknown an investment, the more likely that investment will be sidelined. Permanence and ownership constraints (9% of responses) require appropriate legal structures for rightful claims to carbon offsets generated by a BC initiative.

While such constraints could be viewed as detrimental to large-scale private investment, BC stakeholders should view this reality constructively. Such fundamental risks with carbon market investments are not confined to BC but impact all carbon-offset initiatives. Although these issues may be more nuanced for BC, they may be addressed with similar approaches to terrestrial carbon-offset projects.

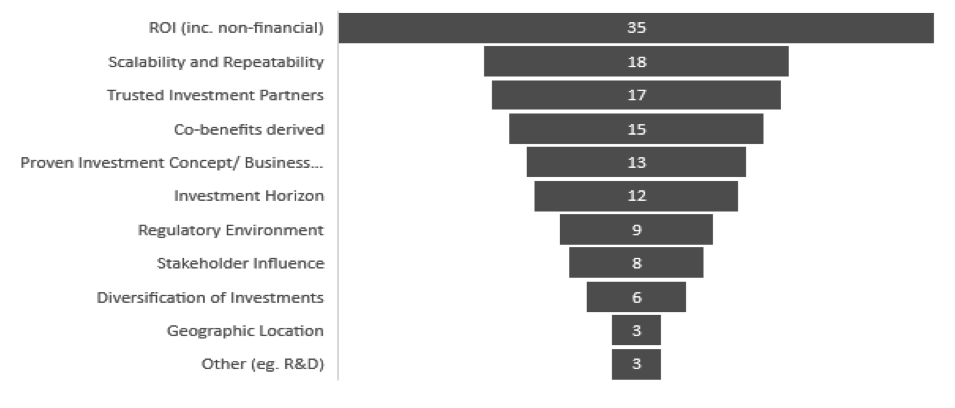

To better understand motivations for investment, respondents were asked to identify the top three factors for considering large-scale investment (Figure 3). What is clear from respondent results is the importance of return on investment in decision making (25% of all responses). This result complements published literature suggesting that large-scale institutional investors are primarily motivated by financial rather than ethical reasons (Amir and George 2018). Scalability and repeatability are also fundamental in private investor decision making, particularly for large-scale investment. Scalability describes an investment’s ability to grow profitably (Nielsen and Lund 2018). An investment with the capability to scale is more likely to deliver improved returns, ostensibly a more attractive investment proposition.

Figure 3. Important Factors for Large-Scale Investment, Number of Responses (n=44)

Source: Author, 2019.

When addressing the return on investment and scalability requirements of private investors, sequestered carbon yield should be a focal point for BC stakeholders. BC ecosystems are up to 10 times more effective at carbon sequestration (McLeod et al. 2011) and twice as effective at carbon storage (Murray et al. 2011) than terrestrial ecosystems. This point of difference speaks directly to the return and scalability parameters private investors seek.

“Co-benefits derived” ranked highly, comprising 11% of responses. Effective financial translation of purported theoretical co-benefit values with BC investment is key (Lau 2013). The proximity of BC ecosystems to existing investments could facilitate effective financial translation of co-benefits for private investors (for example, existing aquaculture investments). By relating quantifiable effects to existing assets or income streams, investors can more accurately account for associated BC co-benefits. Accepted notions of opportunity cost and cost-benefit analysis can be used for investment decision making in these instances. Broadening the total financial and economic value of an investment could effectively mitigate the investment risk profile.

Long-term investment horizons were favored by respondents, with 61% of respondents stating a preference for a seven-or-more-year time frame. Noting this result, a satisfactory financial return on new BC investment may not be reflected until vegetation is established and carbon sequestration occurs. This results in an up-front capital burden for BC investors that may erode potential returns if unmanaged.

Careful consideration for BC ecosystem composition is advisable. Analysis of associated costs for 235 marine restoration studies indicated that mangroves had the lowest cost per hectare, while seagrass had the highest cost per hectare as of 2010 (Bayraktarov et al. 2016). The same study found that seagrass had the lowest restoration success rate (38%) and salt marshes the highest success rate (65%) (Bayraktarov et al. 2016). Based on Bayraktarov’s analysis, seagrass represents the weakest investment option because of its high costs and low project success rate.

Preferred Responsible Investments

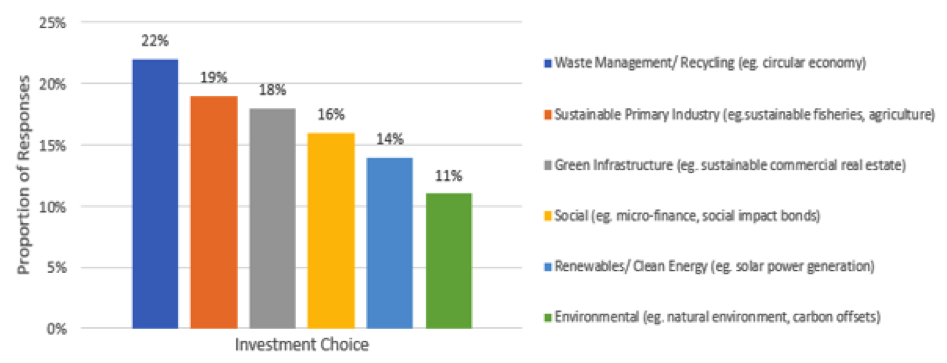

To quantify private investor appetite, respondents were required to rank segmented investment preferences via the “drag-and-drop” ranking tool in the Qualtrics© survey platform. The investment preference list was not intended to be exhaustive but to synthesize established RI sectors. The six choices available in ranking order were: (i) socially responsible investments (e.g., microfinance, social impact bonds); (ii) environmentally responsible investments (e.g., carbon-offset projects); (iii) green infrastructure (e.g., sustainable commercial real estate); (iv) renewable and clean energy (e.g., solar power generation); (v) sustainable primary industry (e.g., sustainable fisheries or agriculture); and (vi) waste management and recycling. To improve the statistical validity of the results, respondents were asked to assume a single investment focus per choice and rank accordingly.

Based on the responses, waste management and recycling was the most preferred investment option while environmentally responsible investments was the least preferred option (Figure 4). An inference that can be drawn from these results is the preference of private investors for established investment sectors with prevailing commercial fundamentals, such as waste management and recycling, sustainable primary industry, and green infrastructure, which were the top three categories respondents chose (Figure 4). An outlier based on the survey results was the low ranking of renewable and clean energy, which was the second-lowest investment preference. Since a majority of respondents were based in Australia, this result is likely a reflection of indecision in energy and emissions policy during the survey period.

Figure 4. Preferred Investment Choices

Source: Author, 2019.

From a BC investment perspective, the low ranking of environmentally themed investments is of concern. Again, the importance of linking the broader social and economic co-benefits of BC resources to viable investment outcomes may serve to offset this low ranking.

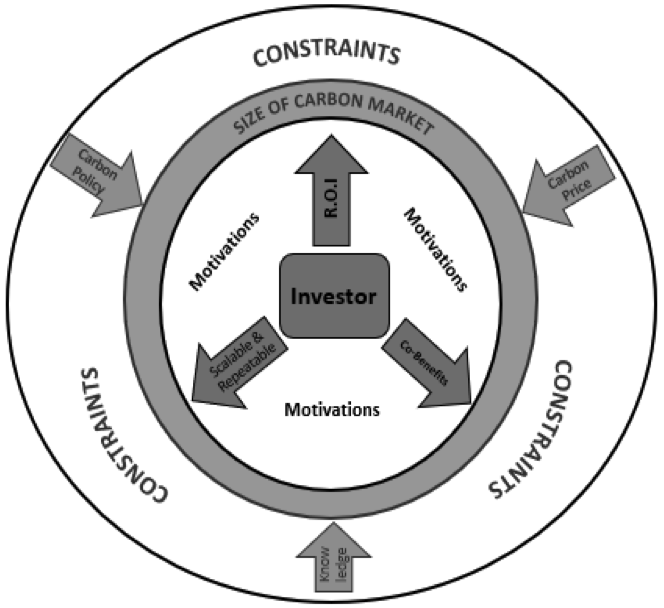

Conceptual Framework for Private Blue Carbon Investment

The

development of a private investment framework for BC is no simple task but

clear pathways need to emerge to guide stakeholders. Using the results of this study,

we developed a conceptual framework aimed at guiding stakeholder dialogue

(Figure 5).

The conceptual framework focuses on the top three carbon market constraints

identified by respondents (i.e., carbon policy, carbon price, and limited

investor knowledge of carbon markets). Conversely motivations for future

private BC investment identified are return on investment (ROI), investment scalability

and repeatability, and co-benefits. By focusing on these key factors,

stakeholders can better determine where to pitch BC for private investment.

Figure 5. Conceptual Model of Blue Carbon Market Constraints and Motivations

Limitations and Recommendations for Future Research

With 44 completed responses, the sample size of the survey was relatively small. Getting the sample size right for survey research isn’t always easy, although this survey size calculator will make things easier. Countering this is the caliber of respondents and their influence in the RI landscape. Despite the anonymous nature of the survey, various respondents chose to contact the authors directly following survey completion, including respondents representing prominent institutions on the Australian investment landscape. Among the organizations respondents worked for are some of the biggest professional services networks in the world (offering audit and assurance services, management consulting, and advisory, actuarial, and corporate finance services); Australian ethical investment firms; the country’s largest commercial and investment banks; government-owned superannuation corporations; and major philanthropic groups.

Geographic coverage of respondents was also a limiting factor. Although this research sought to include global investment perspectives, only four respondents outside Australia completed the survey. While these global insights are valuable, the representation of Australian respondents (90% of completed surveys) heavily contextualizes research findings to an Australian perspective. Further sectoral segmentation would benefit future research. For instance it would be misleading to infer that all for-profit organizations operate with the same investment motives across sectors.

Surveys represent a snapshot in time and can be influenced by prevailing economic and government policy discussions, impacting respondent sentiment. Two significant factors potentially impacting this study were the federal emissions policy debate in Australia regarding the National Energy Guarantee. Additionally, The Global Climate Action Summit held in late September 2018 garnered significant private investor interest, along with commitments from institutional investment actors to invest to meet climate targets. As the summit was held after the survey deadline, some of this positive investor sentiment may not have been captured.

There is an increasing interest in RI as mainstream, private investors become more acquainted with the fundamentals of the field. At present, however, less volatile and established commercial investments hold greater appeal. Promising eco-centric investment signals are emerging, including new green-bond methodologies under development for ecosystem conservation and restoration (Huwyler 2014), both aligning with BC resources.

Closer alignment with global-scale initiatives, particularly the ubiquitous SDGs, may also prove beneficial to BC stakeholders in addressing the familiarity deficit identified by our research. These more established initiatives already have the benefits of scale and discursive influence while also aligning with investor metrics such as impact.

Our study results and conceptual framework may guide more informed interactions with private investors by BC stakeholders. Such interactions will be essential in addressing the BC knowledge gap identified among respondents. Our study also highlights the importance of presenting private investors with quantifiable co-benefits underpinned by credible financial and economic returns.

References

Amir, Amel-Zadeh, and Serafeim George. 2018. “Why and How Investors Use ESG Information: Evidence from a Global Survey.” Financial Analysts Journal 74(3): 87–103. Available from doi: 10.2469/faj.v74.n3.2.

Bayraktarov, Elisa, Megan I. Saunders, Sabah Abdullah, Morena Mills, Jutta Beher, Hugh P. Possingham, Peter J. Mumby, and Catherine E. Lovelock. 2016. “The Cost and Feasibility of Marine Coastal Restoration.” Ecological Applications 26(4): 1055–1074.

Blum, Juliet, and Dorothee Herr. 2017. “Can Restoring Mangroves Help Achieve the Sustainable Development Goals?” IUCN Global Forest and Climate Change Programme. Accessed May 15, 2018. Available from https://www.iucn.org/news/forests/201703/can-restoring-mangroves-help-achieve-sustainable-development-goals.

Calvello, Angelo, ed. 2010. Environmental Alpha: Institutional Investors and Climate Change. Hoboken, New Jersey: John Wiley and Sons, Inc.

Carlsson, Fredrik, Mitesh Kataria, and Elina Lampi. 2018. “Demand Effects in Stated Preference Surveys.” Journal of Environmental Economics and Management 90: 294–302. Available from doi: https://doi.org/10.1016/j.jeem.2018.06.003.

Duarte, Carlos M., Iñigo J. Losada, Iris E. Hendriks, Inés Mazarrasa, and Núria Marbà. 2013. “The Role of Coastal Plant Communities for Climate Change Mitigation and Adaptation.” Nature Climate Change 3: 961. doi: 10.1038/nclimate1970.

Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. “ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies.” Journal of Sustainable Finance & Investment 5(4): 210–233. Available from doi: 10.1080/20430795.2015.1118917.

Huwyler, F. 2014. “How Green Bonds Can Fund a Conservation Renaissance.” Public Radio International. Accessed August 15, 2018.

Huwyler, F., J. Käppeli,

K. Serafimova, E. Swanson, and J. Tobin. 2014. Conservation Finance: Moving Beyond Donor Funding Toward an

Investor-Driven Approach. Zurich, Switzerland: Credit Suisse; WWF; McKinsey

& Company. Accessed

May 20, 2018.

Lau, Winnie W. Y. 2013. “Beyond Carbon: Conceptualizing Payments for Ecosystem Services in Blue Forests on Carbon and Other Marine and Coastal Ecosystem Services.” Ocean & Coastal Management 83: 5–14.

McLeod, Elizabeth, Gail L. Chmura, Steven Bouillon, Rodney Salm, Mats Björk, Carlos M. Duarte, Catherine E. Lovelock, William H. Schlesinger, and Brian R. Silliman. 2011. “A Blueprint for Blue Carbon: Toward an Improved Understanding of the Role of Vegetated Coastal Habitats in Sequestering CO2.” Frontiers in Ecology and the Environment 9(10): 552–560.

Murray, B. C., L. Pendleton, W. Jenkins, and S. Sifleet. 2011. Green Payments for Blue Carbon: Economic Incentives for Protecting Threatened Coastal Habitats. Nicholas Institute Report 11–04. Durham, NC, USA: Nicholas Institute for Environmental Policy Solutions.

Nielsen, Christian, and Morten Lund. 2018 (Winter). “Building Scalable Business Models.” MIT Sloan Management Review 59(2).

Organisation for Economic Co-operation and Development (OECD). 2016. The Private Sector: The Missing Piece of the SDG Puzzle. Edited by the OECD Global Forum on Development. Paris, France: Organisation for Economic Co-operation and Development. Available from https://www.oecd.org/development/financing-sustainable-development/development-finance-topics/blended-finance.htm.

OECD. 2017. Investing in Climate, Investing In Growth (A Synthesis). Oxford, UK: Organisation for Economic Co-operation and Development. Available from https://www.oecd.org/environment/cc/g20-climate/synthesis-investing-in-climate-investing-in-growth.pdf.

PRI. 2018. Principles for Responsible Investment Annual Report 2018. London: PRI Association. Available from https://www.unpri.org/annual-report-2018/.

Responsible Investment Association of Australia (RIAA). 2018. “RI Explained.” Responsible Investment Association of Australia. Accessed August 1, 2018. Available from https://responsibleinvestment.org/what-is-ri/ri-explained/.

Sahlqvist, Shannon, Yena Song, Fiona Bull, Emma Adams, John Preston, David Ogilvie, and the iConnect consortium. 2011. “Effect of Questionnaire Length, Personalisation and Reminder Type on Response Rate to a Complex Postal Survey: Randomised Controlled Trial.” BMC Med Research Methodology 11: 62. Available from doi:10.1186/1471-2288-11-62.

Thomas, Sebastian. 2014. “Analysis: Blue Carbon: Knowledge Gaps, Critical Issues, and Novel Approaches.” Ecological Economics. 107: 22–38. Available from doi: 10.1016/j.ecolecon.2014.07.028.

Tukey, John. W. 1980. “We Need Both Exploratory and Confirmatory.” The American Statistician 34(1): 23. Available from doi: 10.2307/2682991.

Wylie, Lindsay, Ariana E. Sutton-Grier, and Amber Moore. 2016. “Keys to Successful Blue Carbon Projects: Lessons Learned from Global Case Studies.” Marine Policy 65: 76–84. Available from doi: https://doi.org/10.1016/j.marpol.2015.12.020.

Yee, Shannon. 2010. “REDD and BLUE Carbon: Carbon Payments for Mangrove Conservation.” University of California San Diego: Center for Marine Biodiversity and Conservation. Available from https://escholarship.org/uc/item/2bc6j8pz.

Biographies

Ryan Cook is a Master of Environment candidate at the University of Melbourne, Australia. His studies have focused on corporate social responsibility (CSR) in relation to responsible business and investment practices, and in particular on the impact and role responsible investment can play in transitioning to a low-carbon economy. In addition to his current studies, Ryan is also qualified with a Bachelor of Agribusiness (Curtin University, Australia) and a Diploma of Sustainability (Central Institute of Technology, Australia). Before commencing his current master’s studies, Ryan was employed within the Australian financial services sector in senior analytical and advisory roles.

Dr. Sebastian Thomas is director of the Sustainability Science Lab (sustainabilitysciencelab.com) at the University of Melbourne, and works closely with business, government, and civil society organizations on issues of climate change, sustainability innovation, and socio-technical transition. His research examines the social–ecological dynamics of local initiatives in the context of wider policy and market frameworks, and he is particularly interested in environmental approaches to building resilient and healthy communities.